财务报告包括哪些内容(财务报告的三大报表)

The basis of financial analysis

01

财务报告是企业向政府部门、投资者、债权人等与本企业有利害关系的组织或个人提供的,反映企业在一定时期内的财务状况、经营成果、现金流量以及影响企业未来经营发展的重要经济事项的书面文件。

企业的财务报告主要包括资产负债表、利润表、现金流量表、所有者权益(或股东权益)变动表、财务报表附注以及其他反映企业重要事项的文字说明。

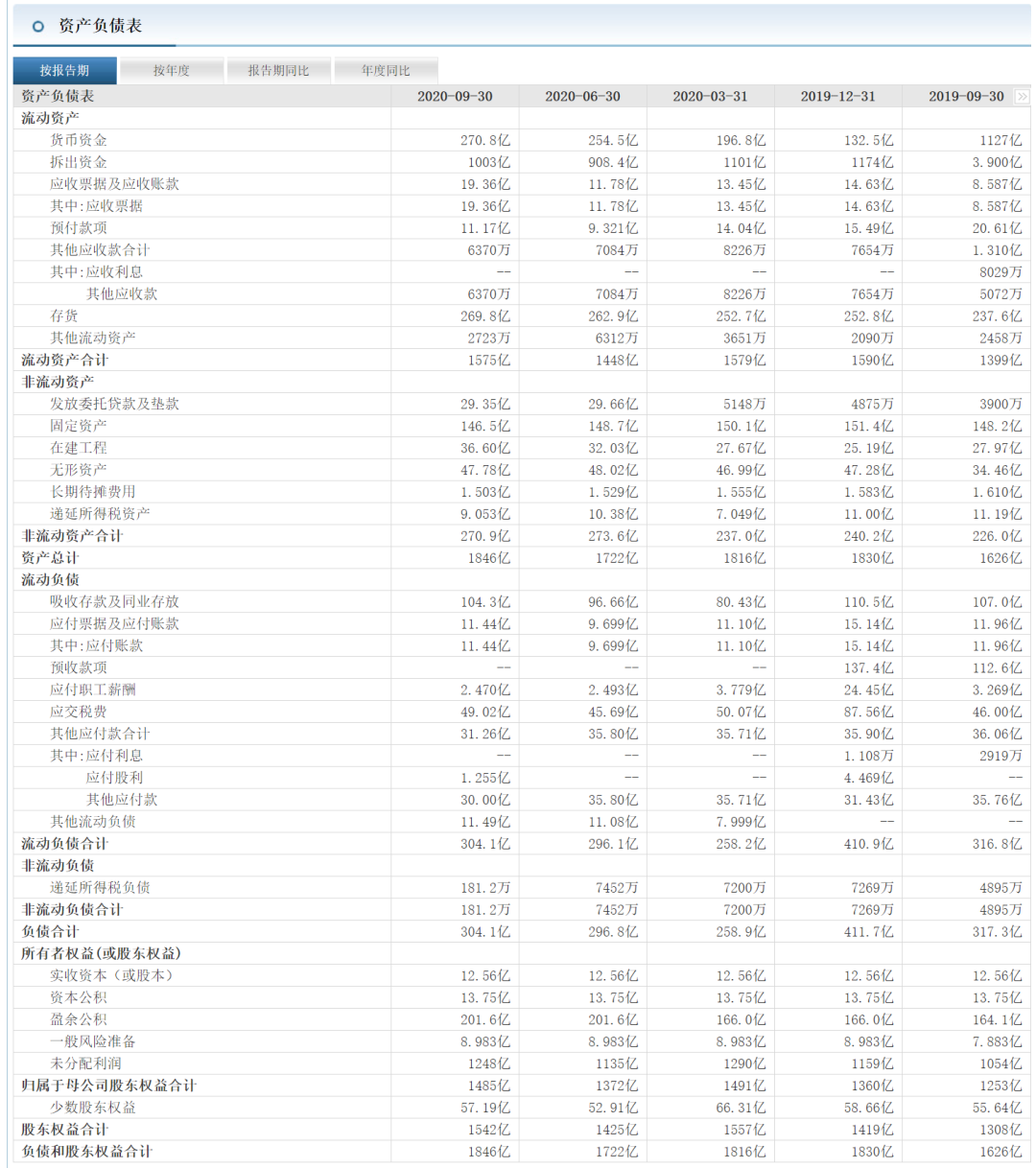

02 资产负债表

资产负债表是反映企业某一特定日期的财务状况的财务报表。它以“资产=负债+股东权益”这一会计等式为依据,反映了企业在某一特定日期资产、负债及股东权益的基本状况。

资产负债表主要包括资产、负债与股东权益三大类项目。左方,资产按流动性从大到小分项列示,上半部分列示了各项流动资产的金额,下半部分列示了各项非流动资产的金额

以贵州茅台为例:

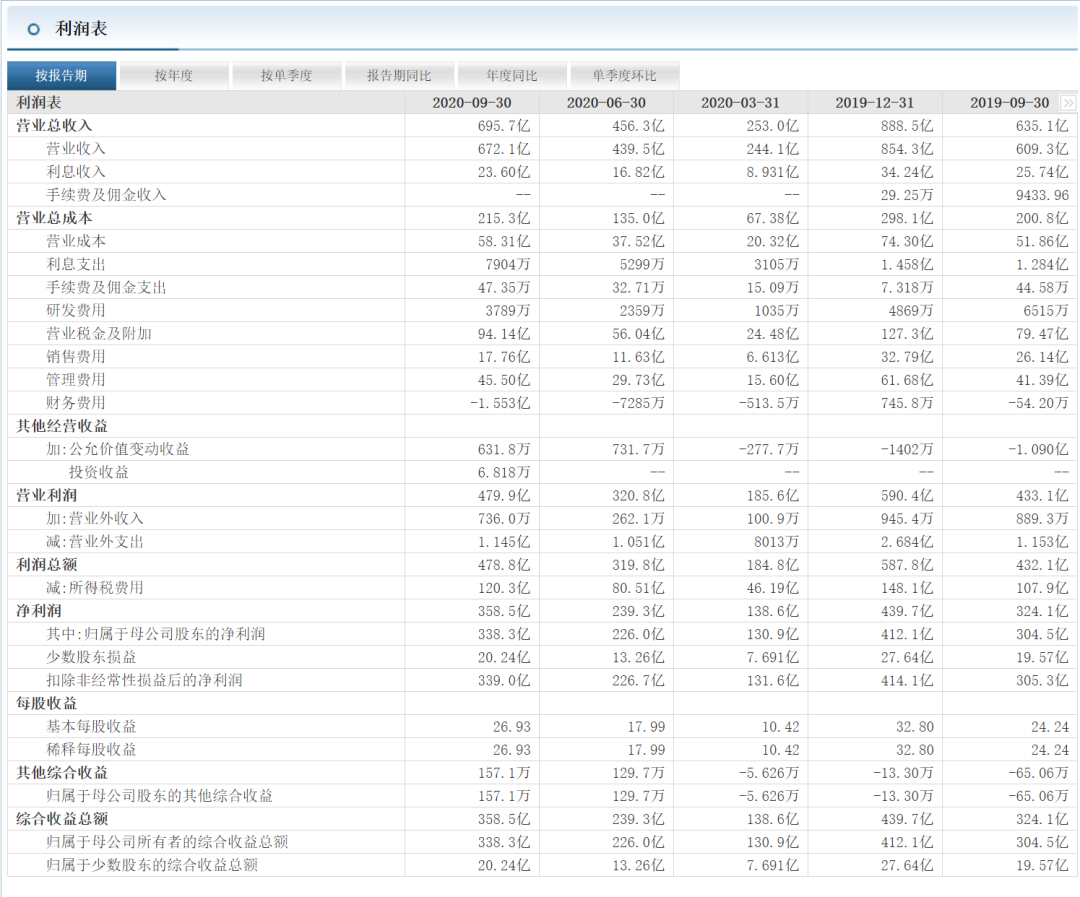

03 利润表

利润表是反映企业在一定期间生产经营成果的财务报表。它以“利润=收入-费用”为依据。

企业的利润可以大体分为三个层次:营业利润、利润总额、利润总额(税前利润)和净利润。

营业利润主要反映企业的经营所得,营业利润+营业外收支净额=利润总额,利润总额-所得税费用=净利润

04 现金流量表

现金流量表是反映企业在一定会计期间的现金流量状况,它将企业的现金流量划分为经营活动产生的现金流量、投资活动产生的现金流量和筹资活动产生的现金流量三类。

现金:企业的库存现金以及可以随时用于支付的存款;

现金等价物:企业特有的期限短(3个月以内)、流动性强、易于转换为已知金额现金、价值变动风险很小的投资

现金流量:企业一定时期内现金和现金等价物的流入和流出的数量

05

Financial reports are provided by companies to government departments, investors, creditors, and other organizations or individuals that have a strong relationship with the company, reflecting the company's financial status, operating results, cash flow, and important economic factors that affect the company's future business development in a certain period of time Written documents of matters.

The financial report of an enterprise mainly includes a balance sheet, an income statement, a cash flow statement, a statement of changes in owner's equity (or shareholders' equity), notes to the financial statements, and other textual descriptions reflecting important matters of the enterprise.

A balance sheet

A balance sheet is a financial statement that reflects the financial status of an enterprise on a specific date. It is based on the accounting equation of "assets = liabilities + shareholders' equity" and reflects the basic status of the company's assets, liabilities and shareholders' equity on a specific date.

The balance sheet mainly includes three types of items: assets, liabilities and shareholders' equity. On the left, assets are listed in descending order of liquidity. The upper half shows the disadvantages of the amount of various current assets, and the lower half shows the amount of various non-current assets.

The profit statement

The profit statement is a financial statement reflecting the production and operation results of an enterprise during a certain period. It is based on "profit = income-expense".

The profit of an enterprise can be roughly divided into three levels: operating profit, total profit, total profit (pre-tax profit) and net profit.

Operating profit mainly reflects the company's operating income, operating profit + net non-operating income and expenditure = total profit, total profit-income tax expense = net profit

The cash flow statement

The cash flow statement reflects the cash flow of an enterprise in a certain accounting period. It divides the cash flow of the enterprise into three types: cash flow from operating activities, cash flow from investment activities and cash flow from financing activities.

Cash: cash in stock of the company and deposits that can be used for payment at any time;

Cash equivalents: a company-specific investment with short term (within 3 months), strong liquidity, easy conversion into known amount of cash, and low risk of value changes

Cash flow: the amount of inflows and outflows of cash and cash equivalents in a certain period of time